Teaching Financial Clarity Through Real Experience

We've spent years working with investors who need clear, accurate financial reports. And honestly, we've seen what happens when the information gets muddy or overly complicated.

Our teaching approach isn't about dumping theory on you. It's about showing you what actually matters when you're preparing reports that investors will trust and use to make decisions.

How We Actually Teach This Stuff

Three core principles shape every program we run. They're based on what we've learned from training dozens of analysts over the years.

Case-Based Learning

You'll work through real reporting scenarios from start to finish. We use anonymized examples from actual client engagements, so you see the messy parts alongside the polished final reports. No theoretical fluff here.

Iterative Feedback Loops

Submit your work, get detailed feedback within 48 hours, revise it, and resubmit. We cycle through this process multiple times because that's how you actually improve. One-and-done assignments don't teach much.

Technical Tools Focus

Our programs emphasize practical software skills. You'll use the same reporting tools and templates we use for client work. By the end, you'll have a portfolio of reports you can show potential employers.

Structured But Flexible Timeline

Our autumn 2025 program runs for 14 weeks starting in September. You'll commit about 12 hours per week on average, though some weeks demand more when you're deep in a case study.

We've structured it so you can balance this with a full-time job. Most participants do. Evening sessions happen twice a week, and you can access recorded materials anytime if you miss a live discussion.

The schedule adapts slightly based on how quickly your cohort moves through material. Some groups fly through early modules and want to dig deeper into advanced topics. We adjust.

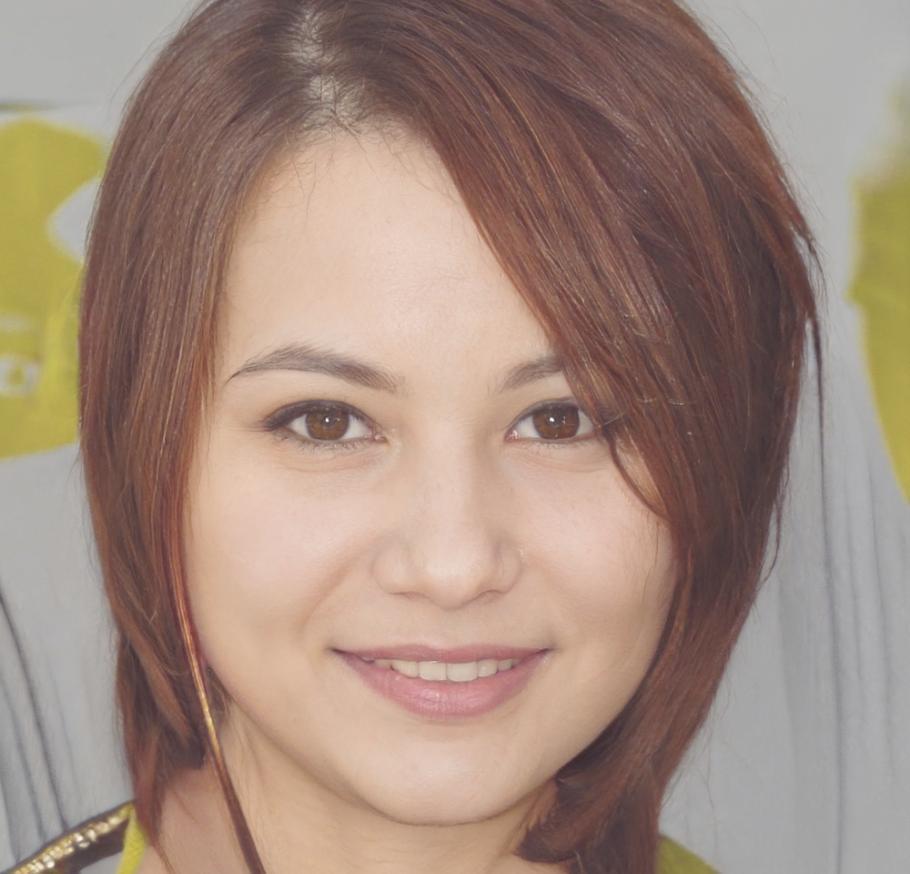

Who's Teaching You

These are the people who'll review your work and guide you through the program. They're all active practitioners who still work on client reporting projects, so they bring current insights rather than outdated textbook knowledge.

Callum Brennan

Lead Instructor, Reporting StandardsCallum handles complex multinational reporting projects. He's particularly good at explaining regulatory requirements without making your brain hurt. Been with us since 2019.

Rhea Novak

Senior Analyst, Technical TrainingRhea specializes in software implementation and automation. If you want to learn how to build efficient reporting workflows, she's your person. Previously worked at a Big Four firm.

Imogen Hartley

Program Director, Case DevelopmentImogen oversees curriculum design and creates most of our case studies. She's worked with over 200 startups on investor reporting and brings that startup perspective into the program.